Exploring the Growth: Top 10 Most Developed African Countries in 2024

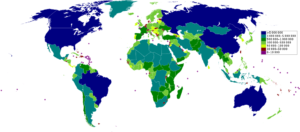

This exploration delves into the top 10 most developed countries in Africa, spotlighting those that have achieved remarkable progress in their human development scores and economic growth rates. By examining factors like the HDI, the fastest-growing African economies, and the strategic reforms shaping their ascent, the article offers insights into what distinguishes these nations as the most developed in Africa and their contribution to the continent’s overall resilience and development trajectory [1][2].

Seychelles

Seychelles, ranked as the second most developed African country with an HDI of 0.785, showcases a blend of economic resilience and developmental challenges [1]. Here are some key insights into its economic indicators and strategic initiatives:

Economic Performance and Projections:

- GDP Growth: After a robust growth of 8.9% in 2022, the GDP growth rate is expected to moderate to 3.3% in 2023, with a further projection of 3.9% in 2024 [3][6].

- Inflation Trends: The inflation rate witnessed a decrease to -2.7% in 2023 but is projected to rise to 3.4% in 2024 [3].

- Fiscal Health: Public debt has declined to 60.1% of GDP in 2023, indicating improved fiscal management [3]. The fiscal deficit is also projected to decline from 1.6% of GDP in 2023 to a mere 0.4% in 2024 [5].

Development Challenges and Strategic Responses:

- Social and Economic Challenges: Seychelles face several development hurdles including labour and skills shortages, teenage pregnancy, and substance addiction [3]. To address these, the government prioritizes reforms in revenue administration, public financial management, and governance [3].

- Environmental and Climate Initiatives: The country is actively enhancing its climate change adaptation strategies. This includes the Southwest Indian Ocean Fisheries Governance and Shared Growth Program (SWIOFish3) which is part of efforts funded by $15 million from the Seychelles Blue Bond [3].

Support from International Organizations:

- World Bank Engagement: The Seychelles Country Partnership Framework by the World Bank focuses on inclusion, public-sector performance, and support for the government’s Blue Economy Program [3]. The World Bank’s portfolio in Seychelles includes significant projects like the Solid Waste Management Project and advisory services in financial sector development [3].

- IMF Involvement: Seychelles has engaged in six arrangements with the IMF, with the most recent discussions held in April 2024. These arrangements have been crucial in maintaining economic stability and addressing fiscal challenges [6].

Seychelles’ approach to tackling its developmental challenges while capitalizing on economic growth opportunities exemplifies its strategic efforts to enhance its standing among the most developed African countries.

Mauritius

Mauritius, an upper-middle-income country, stands out as the most developed African nation as of 2021, with significant achievements in various development indicators [1][9]. Here’s a detailed look at its key metrics and strategic initiatives:

Geography and Demographics:

- Location and Size: Situated in Eastern Africa, Mauritius covers an area of 2,040 km² [8].

- Population: The island is home to approximately 1,264,000 people [8].

- Capital and Currency: Port Louis serves as the capital, and the Mauritian rupee is the official currency (1 EUR = 49.5095 MUR) [8].

Economic Indicators:

- GDP and Growth: Mauritius experienced a GDP contraction of 14.6% in 2020 due to the COVID-19 pandemic but rebounded impressively with growth rates of 3.5% in 2021 and 8.9% in 2022. The projected growth for 2023 stands at 6.8% [9].

- Inflation and Public Debt: The twelve-month average headline inflation moderated to 7% in 2023. The national debt reached 11,036 million euros, marking an 83.09% debt-to-GDP ratio, with a per capita public debt of approximately $9,201 [8][9].

Development and International Standing:

- Human Development Index (HDI): With an HDI score of 0.802, Mauritius ranks 64th globally and first in Africa, categorizing it within the ‘very high human development’ group [1][8].

- Healthcare and Education: The country boasts a life expectancy of 75 years and a literacy rate of 91.3%, underpinned by free healthcare and schooling systems [1].

- Environmental Goals: Committed to sustainable development, Mauritius aims to source 60% of its energy from renewable resources by 2030 [9].

Business Environment:

- Ease of Doing Business: Mauritius is ranked 13th globally in the Doing Business ranking, which evaluates the regulatory environment for local firms [8].

This comprehensive overview highlights Mauritius’s robust economic recovery, strong development metrics, and strategic positioning in international rankings, underscoring its status as a leader among the most developed African countries.

Algeria

Economic Overview:

- GDP Growth: Algeria’s real GDP growth is set to slow down, from 3.1% in 2023 to 2.1% in 2024, with a further decrease to 1.8% expected [10][11]. This deceleration is attributed to various economic challenges, despite a temporary boost from increased gas exports due to geopolitical shifts [11][12].

- Inflation and Budget: Inflation in Algeria is expected to decrease from 7.7% in 2023 to 6.7% in 2024. However, the budget deficit is projected to widen, reaching 5.0% of GDP by 2024, signalling fiscal pressures [10].

Economic Challenges and Strategic Initiatives:

- External Trade and Investment: The external current account is anticipated to maintain a surplus, shrinking slightly from 3.0% of GDP in 2023 to 2.4% in 2024. This is bolstered by rising hydrocarbon export income, which will also increase Algeria’s foreign exchange reserves in the medium term [10][11].

- Business Environment: Economic prospects are hampered by an overcentralized management system and an opaque business environment, dominated by a few vested interests. These factors pose significant barriers to foreign investment and economic diversification [11].

- Fiscal Reforms: Anticipated fiscal pressures towards the latter part of the forecast period (2024-2028) are expected to push the government towards implementing fiscal reforms and seeking external borrowing, primarily from bilateral allies [11].

Future Economic Projections:

- GDP Projections: By 2028, Algeria’s GDP is estimated to peak at 262.8 billion U.S. dollars, with a total growth of 17.27% from 2023 to 2028. This growth, however, is constrained by factors such as declining hydrocarbon production and easing import restrictions, which impact net exports negatively [13][12].

- Public Spending: Efforts to mitigate economic downturns include increases in public salaries and capital expenditures. These measures are intended to alleviate some of the economic headwinds, although they may not fully offset the broader fiscal challenges [12].

Algeria’s position as the third most developed country in Africa, with an HDI of 0.745, reflects its mixed economic landscape, where strategic advantages in natural resources are juxtaposed against structural economic challenges [1].

Tunisia

Economic Initiatives and International Relations:

- World Bank Support: Tunisia has been the recipient of substantial financial aid from the World Bank, including a US$300 million loan for the Emergency Food Security Response Project and a US$220 million loan for the Tunisia Economic Development Corridor project. These initiatives aim to enhance food security and economic equality across regions [14].

- Emergency Food Security Project: This project is crucial for improving wheat imports and supporting small-scale producers. It has provided barley to 126,000 dairy farmers and climate-smart wheat seeds to 16,362 smallholder farmers, ensuring the continued supply of bread with 160,099 metric tons of soft wheat distributed [14].

- Economic Development Corridor: Focused on the Kasserine – Sidi Bouzid – Sfax corridor, this project plans to develop infrastructure with 65 km of roadworks, upgrade 117 km of feeder roads, and improve SMEs’ access to finance, benefiting local households, businesses, and particularly women [14].

Diplomatic Engagements:

- Tunisia-China Relations: In a significant diplomatic engagement, Tunisian President Kais Saied met with Chinese Foreign Minister Wang Yi, reaffirming a 60-year stable relationship. Tunisia supports the one-China principle and opposes foreign interference under the guise of human rights and democracy, aligning with China’s stance on non-interference [15].

- Bilateral Cooperation: Both nations are committed to deepening cooperation in various fields, emphasizing political mutual trust and economic collaboration. China has expressed firm support for Tunisia’s sovereignty and national dignity, highlighting a mutual interest in each other’s core concerns and developmental aspirations [15].

Upcoming Events:

- Aquaculture Africa 2024 Conference: Scheduled to take place in Hammamet from November 19 to 22, 2024, this conference, themed “Blue Farming: New Horizons for Economic Growth,” is set to attract thousands of delegates globally. Tunisia’s growing reputation as a leading aquaculture producer in Africa positions it as a pivotal player in the sector’s future [16].

Botswana

Economic Profile and Challenges:

- GDP and Economic Growth: Botswana’s economy, historically reliant on diamonds, has seen a slowdown in growth to 3.3% in 2023 from 5.8% in 2022 due to a decline in diamond production and prices amid weaker global demand [17].

- Unemployment and Poverty: Structural unemployment remains a significant issue with a rate of 25.9% as of the third quarter of 2023. Despite a relatively high-income level, poverty persists across the country [17].

- Public Debt: The national debt stood at 3,535 million euros in 2022, equating to a 17.98% debt-to-GDP ratio, with a per capita public debt of approximately €1,366 [18].

Development Indices and International Support:

- Human Development Index (HDI): Botswana scored 0.693 on the HDI in 2021, ranking it 117th globally, which reflects moderate human development [18].

- World Bank and IFC Involvement: The World Bank has been actively supporting Botswana in areas such as water availability in drought-prone regions and wastewater management. The International Finance Corporation (IFC) focuses on fostering private sector-led growth and economic diversification [17].

- Multilateral Investment Guarantee Agency (MIGA): MIGA provides political risk insurance to encourage foreign investments, supporting Botswana’s development agenda [17].

Economic and Political Indices:

- Doing Business and Economic Transformation: Botswana ranks 87th in the Doing Business index, indicating challenges yet potential in the business environment. Its economic transformation index stands at 27 out of 137, showing room for improvement in economic policies and practices [18][20].

- Governance and Political Stability: The governance index position at 11 out of 137 highlights Botswana’s relatively stable political environment, which is conducive to its developmental goals [20].

Rwanda

Economic Resilience and Growth Projections:

- GDP Growth: Rwanda’s economy demonstrated robustness with a 7.6% growth rate in the first three quarters of 2023, and it’s projected to maintain a strong average growth of 7.2% from 2024 to 2026 [22][23].

- Sectoral Contributions: Anticipated recovery in sectors such as global tourism, new construction projects, and increased manufacturing activities are expected to drive economic growth during this period [23].

- Fiscal Management: The government is focusing on fiscal consolidation, aiming to reduce subsidies, oversee state-owned enterprises, and introduce tax policy measures to broaden the revenue base [23].

Challenges and Strategic Initiatives:

- Public Debt and Investment: Public-sector-led development has increased public debt, with significant reliance on large public investments leading to substantial fiscal deficits [22]. To address this, the World Bank Group’s Country Partnership Framework (CPF) for FY21–FY26 focuses on catalyzing higher volumes of private resources [22].

- Private Sector Constraints: Key barriers to private investment include low domestic savings, a shortage of skills, and high energy costs [22]. Efforts are underway to implement subsidies and incentives, educational programs promoting the benefits of saving, and comprehensive policy approaches to boost domestic savings [23].

Risks and Mitigation Strategies:

- Economic Risks: Disruptions to the global economy, trade variations, and lower availability of concessional resources pose risks to Rwanda’s economic outlook [23].

- Environmental Impact: Frequent weather-related shocks could decrease food production and increase food prices, adversely affecting poor households. Strategies to engage the Rwandan diaspora and leverage digital financial literacy programs are being considered to enhance domestic savings and mitigate these risks [23].

Gabon

Economic and Development Overview:

- GDP and Economic Projections: Gabon’s economic growth has been moderate, with a growth rate of 2.3% in 2023 and a projected rate of 2.6% for 2024 [24][26]. Despite being rich in natural resources like forests, fisheries, and minerals, Gabon faces challenges in translating these assets into sustainable, inclusive growth [24].

- Public Debt and Inflation: The public debt in Gabon reached 57.4% of GDP in 2023, with an inflation rate standing at 2.7% as of October 2023 [24]. These figures reflect the economic pressures and the need for fiscal management and reform.

Sociopolitical Landscape:

- Population and Urbanization: With a population of approximately 2.3 million in 2021, over 80% of Gabon’s residents live in urban centres, primarily in Libreville and Port-Gentil [24]. This high urbanization rate presents both opportunities and challenges for infrastructure development and service delivery.

- Political Changes: In 2023, President Ali Bongo was deposed following a military intervention, with General Brice Clotaire Oligui Nguema stepping in as the transition president [24]. This political shift could impact the nation’s stability and economic policies moving forward.

World Bank Involvement and Future Outlook:

- World Bank Projects: Since joining the World Bank in 1963, Gabon has benefited from over 20 projects across various sectors. Currently, the World Bank’s portfolio includes two active projects in the digital development sector, with a total commitment of $145.50 million [24].

- Country Partnership Framework (CPF): Running from 2023 to 2027, the CPF aims to aid Gabon’s transition towards more sustainable and inclusive economic growth. Key focus areas include improving public service delivery, increasing access to social services, promoting resilient urban infrastructure, and boosting private investment in non-oil sectors [24].

South Africa

Economic Overview and Challenges:

- GDP Growth: South Africa’s real GDP growth is forecasted to be 1.8% in 2024 and 1.6% in 2025, indicating a steady yet modest economic expansion [29].

- Budget and Taxation: The budget deficit is expected to increase to 4.9% of GDP in 2023, with gross debt projected to rise to 77.7% of GDP by the 2025/26 fiscal year. To address revenue shortfalls, proposals include raising an additional R15bn in tax revenues through various measures such as increasing personal income tax rates or the VAT rate [31].

- Sectoral Challenges: Persistent issues such as power cuts, operational problems in freight rail and ports, and high living costs continue to disrupt economic activity and hinder the country’s export potential [32].

Strategic Economic Reforms:

- Comprehensive Sector Reforms: South Africa is implementing reforms across multiple sectors including energy, freight logistics, ports, water, and telecommunications to stimulate economic growth [32].

- Energy Sector Initiatives: New private-sector investments are expected to add 12GW of power generation capacity. Additionally, reforms in the electricity sector aim to integrate over 11GW of renewable sources to address the ongoing power crisis [33].

- World Bank Involvement: The World Bank has been actively supporting South Africa through various initiatives:

- A $497 million Eskom Just Energy Transition Project was approved to support energy sector reforms [30].

- A $1 billion Development Policy Loan was sanctioned to help mitigate the energy crisis [30].

- An $8.9 million grant from the Global Environment Facility is aimed at enhancing the wildlife and biodiversity sectors [30].

Economic Outlook and Projections:

- Private Sector and Investment: Increased private sector investments are being facilitated through the International Financing Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA), focusing on enhancing the business environment and economic resilience [30].

- Future Economic Positioning: According to the IMF, South Africa is set to surpass Nigeria and Egypt as the continent’s largest economy in 2024, highlighting its potential for economic leadership in Africa [35].

Egypt

Egypt is spearheading ambitious projects to bolster its infrastructure and economic landscape, aiming to enhance its position as one of the most developed countries in Africa. Here are some of the pivotal developments:

1. New Alamein City:

- Scope and Scale: Spanning 50,000 acres, designed to accommodate 3 million residents, making it a fourth-generation smart city [36].

- Investment and Employment: Attracts a total investment of approximately 6 billion US dollars, creating over 40,000 job opportunities [36].

- Infrastructure and Tourism: Features include a high-speed train connecting to Cairo, a smart traffic management system, and plans to develop the Mediterranean beaches to boost tourism [36].

- Hospitality Development: Permits have been granted to 30 developers to construct hotels with a total of 30,000 rooms [36].

- Iconic Structures: The AL Alamain Towers, serving as the grand entrance, will include entertainment areas, swimming pools, and hanging gardens [36].

2. Transportation Innovations:

- Herota Lxer High-Speed Rail: A $23 billion project set to transform Egypt’s transportation system with the first line connecting Asakna to the Mediterranean, and subsequent phases linking major cities and ports [36].

- Speed and Efficiency: The rail system, reaching speeds up to 250 kmph, will be the second fastest in Africa, enhancing connectivity and economic integration [36].

3. Industrial and Energy Developments:

- Terer Petrochemical Complex: Located in the Suez governorate, this $11 billion project covers 3.56 million square meters and includes a 4 million ton per annum Naphtha cracker plant, the largest globally [36].

- Production Capacity: The complex will produce 1.4 million tons of ethylene and polyethene, 900,000 tons of propylene, and other significant quantities of chemical products annually [36].

- L Deah Nuclear Power Plant: Egypt’s first nuclear power plant costing $29 billion, is expected to generate 4800 megawatts of nuclear power, which will significantly contribute to the country’s energy needs [36].

- Financial Structure: Funded predominantly by a state loan from Russia covering 85% of the costs, with Egypt contributing the remaining 15% [36].

These projects demonstrate Egypt’s proactive approach in enhancing its infrastructure and economic capabilities, positioning it as a leader in sustainable and innovative development in Africa.

Morocco

Morocco’s economic landscape in 2024 is shaped by a mix of resilience and challenges, reflecting its diverse economic activities and the impact of environmental factors:

Economic Performance and Projections:

- GDP Growth: The real GDP growth rate is anticipated to be around 3.6%, with projections indicating a slight dip below 3% due to the ongoing drought affecting agricultural output [41][42].

- Inflation and Consumer Prices: Inflation surged to 6.3% in 2023 but is projected to stabilize around 2.8% in 2024, influenced by nominal GDP growth and controlled consumer price inflation [45][44].

- Tourism and Employment: Despite environmental challenges, tourism has shown significant recovery, with tourist arrivals in 2023 exceeding pre-pandemic levels by 12.3%. However, unemployment has spiked to 13%, primarily due to job losses in agriculture [47][45].

Fiscal Health and International Support:

- Fiscal Deficit and Debt Management: The fiscal deficit is expected to stabilize at close to 5% of GDP. Morocco’s strategy includes managing a substantial public debt, which benefits from international support such as a US$5bn IMF precautionary credit line [42].

- External Balances: Thanks to a shrinking current-account deficit bolstered by strategic international financial support, the country’s external balances are improving [42].

Strategic Economic Initiatives:

- Sector Diversification: Key sectors driving economic diversification include tourism, automotive manufacturing, and phosphates. These sectors not only contribute to GDP growth but also to job creation and export revenues [47].

- Social and Fiscal Reforms: The government is working on phasing out subsidies on essential commodities like butane gas, wheat, and sugar. This move is intended to free up resources for expanding health care coverage and targeted family allowances, aiming to formalize more of the economy and enhance inclusivity [47].

These economic insights into Morocco highlight its efforts to maintain growth and stability amidst challenges, while strategically positioning itself for sustainable development.

Conclusion

Through this exploration into the developmental strides of Africa’s top-tier countries, it becomes evident that despite facing a myriad of challenges, significant progress is being made across the continent. From Seychelles’ innovative approaches to counter developmental hurdles to Mauritius’ remarkable economic recovery and its leadership in human development indices, each country’s story is a testament to African resilience and ambition. The detailed examination of their economies, strategic reforms, and international partnerships shed light on the complexities of development and the diverse paths nations can take towards growth and improved quality of life for their citizens.

The broader implications of these developments are profound, not only for the countries in question but for Africa as a whole, and potentially for the global community. The advancements in infrastructure, health care, education, and economic diversification highlighted in this article underscore the continent’s significant potential for future growth. Further research and active engagement from both public and private sectors at a global level could immensely support these nations in overcoming their remaining challenges. As the continent continues to emerge as a formidable economic player, the stories of these ten countries serve as both inspiration and a call to action for fostering sustainable development and inclusive growth in Africa.

FAQs

1. Which are the top 10 Most Developed African Countries in 2024?

As per the Human Development Index (HDI) in 2024, the top 10 most developed countries in Africa are Mauritius, Seychelles, Algeria, Egypt, Tunisia, Libya, South Africa, Gabon, Botswana, and Morocco. Mauritius leads the ranking with an HDI score of 0.802.

2. Which economies are growing the fastest in Africa in 2024?

In 2024, the economies showing the most rapid growth in Africa include Niger, Senegal, Ivory Coast, the Democratic Republic of the Congo (DRC), and Rwanda.

3. What is the wealthiest country in Africa in 2024?

According to the International Monetary Fund (IMF) in 2024, Mauritius is the wealthiest country in Africa with a GDP-PPP (Purchasing Power Parity) per capita of $31,157. It is followed by Libya, Botswana, Gabon, Egypt, Equatorial Guinea, South Africa, and Algeria.

4. What are the top 10 fastest-growing countries in Africa?

The leading countries in Africa with the fastest economic growth rates are Niger (11.2%), Senegal (8.2%), Libya (7.9%), Rwanda (7.2%), Cote d’Ivoire (6.8%), Ethiopia (6.7%), Benin (6.4%), Djibouti (6.2%), Tanzania (6.1%), Togo (6%), and Uganda (6%).

References

[1] – https://worldpopulationreview.com/country-rankings/most-developed-countries-in-africa[2] – https://www.afdb.org/en/news-and-events/press-releases/africa-dominates-list-worlds-20-fastest-growing-economies-2024-african-development-bank-says-macroeconomic-report-68751

[3] – https://www.worldbank.org/en/country/seychelles/overview

[4] – https://www.undp.org/mauritius-seychelles/blog/human-development-report-2023/2024-snapshot-trends-seychelles

[5] – https://www.afdb.org/en/countries/east-africa-seychelles/seychelles-economic-outlook

[6] – https://www.imf.org/en/Countries/SYC

[7] – https://www.fitchratings.com/research/sovereigns/fitch-revises-outlook-on-seychelles-to-positive-affirms-at-bb-15-03-2024

[8] – https://countryeconomy.com/countries/mauritius

[9] – https://www.worldbank.org/en/country/mauritius/overview

[10] – https://www.imf.org/en/Countries/DZA

[11] – https://country.eiu.com/algeria

[12] – https://www.fitchsolutions.com/bmi/country-risk/algeria-set-significant-economic-slowdown-2024-30-01-2024

[13] – https://www.statista.com/statistics/408059/gross-domestic-product-gdp-in-algeria/

[14] – https://www.worldbank.org/en/news/press-release/2024/03/15/tunisia-world-bank-projects-boost-food-security-economic-opportunities

[15] – http://us.china-embassy.gov.cn/eng/zgyw/202401/t20240117_11227908.htm

[16] – https://www.bluelifehub.com/2024/03/11/aquaculture-africa-2024-conference-scheduled-for-tunisia-in-november-2024/

[17] – https://www.worldbank.org/en/country/botswana/overview

[18] – https://countryeconomy.com/countries/botswana

[19] – https://www.imf.org/en/Countries/BWA

[20] – https://bti-project.org/en/reports/country-report/BWA

[21] – https://bti-project.org/en/reports/country-dashboard/BWA

[22] – https://www.worldbank.org/en/country/rwanda/overview

[23] – https://www.worldbank.org/en/news/press-release/2024/02/28/rwanda-afe-economic-performance-strengthened-in-2023-despite-continued-challenges

[24] – https://www.worldbank.org/en/country/gabon/overview

[25] – https://bti-project.org/en/reports/country-report/GAB

[26] – https://www.imf.org/en/Countries/GAB

[27] – https://countryeconomy.com/countries/gabon

[28] – https://www.strategyand.pwc.com/a1/en/insights/south-africa-economic-outlook.html

[29] – https://country.eiu.com/South%20Africa

[30] – https://www.worldbank.org/en/country/southafrica/overview

[31] – https://www.strategyand.pwc.com/a1/en/press-release/south-africa-economic-outlook-feb-2024.html

[32] – https://www.treasury.gov.za/documents/National%20Budget/2024/review/Chapter%202.pdf

[33] – https://www.fitchratings.com/research/sovereigns/south-africa-15-02-2024

[34] – https://www.deloitte.com/za/en/services/tax/perspectives/south-african-economic-outlook.html

[35] – https://www.chathamhouse.org/2024/01/whats-stake-africa-2024

[36] – https://www.youtube.com/watch?v=kEDdMZ7PhGY

[37] – http://www.exhibitionstand.contractors/en/news/721/Egypt-Projects-2024-Cairo-Egypt

[38] – https://www.dailynewsegypt.com/2024/02/20/egypts-2024-25-economic-plan-prioritizes-private-sector-infrastructure-social-development/

[39] – https://www.worldbank.org/en/news/statement/2024/03/18/world-bank-group-statement-of-support-to-egypt-s-development-and-reform-efforts

[40] – https://www.dailynewsegypt.com/2024/04/01/egp-82-7bn-allocated-for-586-development-projects-in-giza-during-2023-2024-planning-ministry/

[41] – https://www.imf.org/en/Countries/MAR

[42] – https://country.eiu.com/morocco

[43] – https://www.worldeconomics.com/Country-Size/Morocco.aspx

[44] – https://www.maroc.ma/en/news/moroccos-economy-grow-32-2024-statistics-office

[45] – https://www.moroccoworldnews.com/2024/02/360949/adb-moroccos-economic-growth-upticks-to-3-5-in-2024

[46] – https://www.economy.com/morocco/indicators

[47] – https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3146424

[48] – https://en.wikipedia.org/wiki/List_of_African_countries_by_Human_Development_Index

[49] – https://www.worldbank.org/en/news/press-release/2024/04/08/african-afe-afw-economies-projected-to-grow-in-2024-but-faster-and-more-equitable-growth-needed-to-reduce-poverty

[50] – https://www.brookings.edu/articles/development-financing-foresight-africa-2024/

[51] – https://www.developmentaid.org/news-stream/post/174553/foresight-africa-2024

[52] – https://www.worldbank.org/en/region/afr/overview